'Buy the Umbrella' - Issue #46

Hi there!

Here is your latest dose of ‘Buy the Umbrella’, a short list of interesting things we’ve been reading and thinking about during the week.

If you missed our prior issue, you can find it here.

Quotes

“If you count the current events, we have now had three economic and financial crises this century and it is still in its first quarter. This would seem to illustrate that attempts to expunge volatility from the financial system are actually producing the opposite of the desired effect.”

— Terry Smith (FundSmith Founder and Chief Executive Officer)

"… defence is ten times more important than offence. The wealth you have can be so ephemeral; you have to be very focused on the downside at all times."

— Paul Tudor Jones (Hedge fund manager)

Charts

Year in review

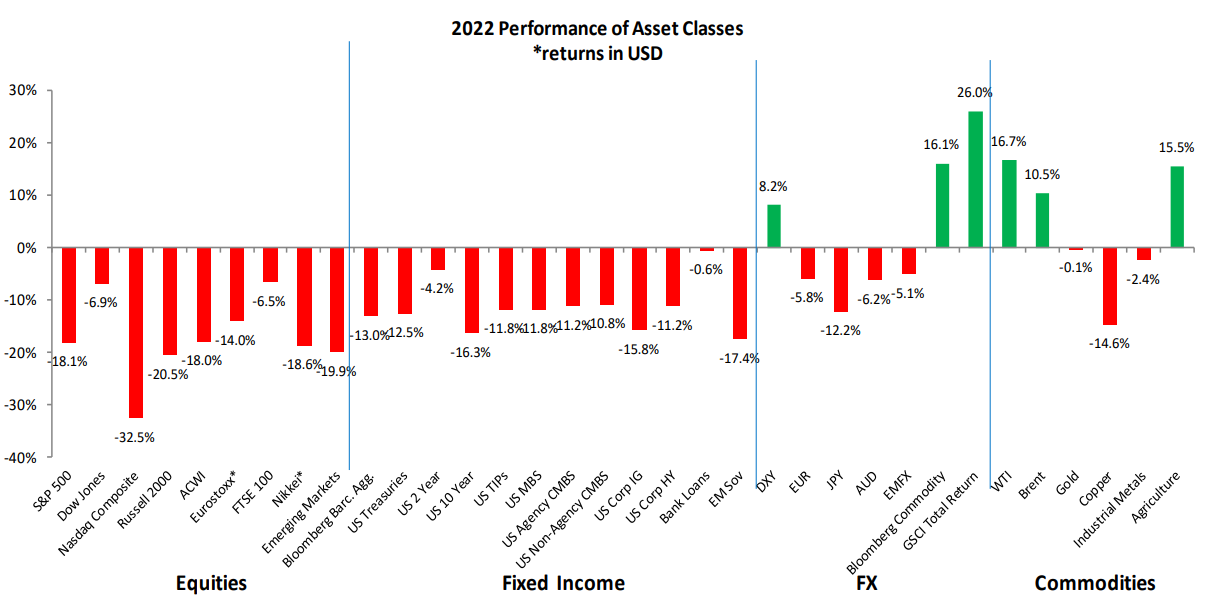

2022 was a tough year for long-only investors as most major central banks exited loose monetary policies (aka ‘easy money’) and interest rates rose around the world. Both equities and bonds declined, in many cases into the double digit territory.

“It is inevitable that when interest rates rise, as they have now to combat inflation, longer-dated bonds fall more than short-dated ones, and so it is with equities with more highly rated shares — which are discounting earnings or cash flow further into the future — suffering 5 more in the downturn than lowly rated or so-called value stocks.” - Terry Smith

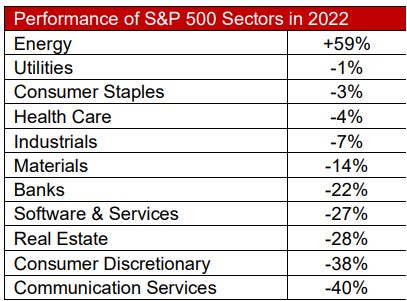

With that backdrop in mind and higher oil prices, it is perhaps unsurprising to see energy equities as the only positive performing sector within the S&P 500 index:

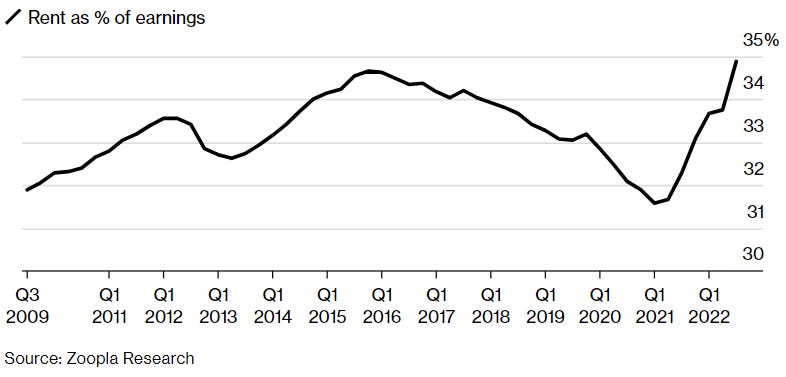

U.K. household’s spend 35% of their earnings on rent

In the UK, rents continued to soar throughout most of 2022 and despite rising wages, Zoopla finds that households are paying a larger share of their incomes on rents.

The Guardian wrote a great piece on the affordability challenges facing the U.K. housing market, highlighting that some are paying as much as 50% of their combined household wages on rents alone.

According to The Guardian, the average advertised rent in Greater London approached £2,343 and is “16.1% higher than a year ago, the highest rate of growth of any region on record”. Interestingly, other towns and cities in the U.K. have faced even larger annual increases: 22.2% in Newbury, 20.5% in Manchester, 19.6% in Cardiff, 18% in Edinburgh and 17.6% in Birmingham.

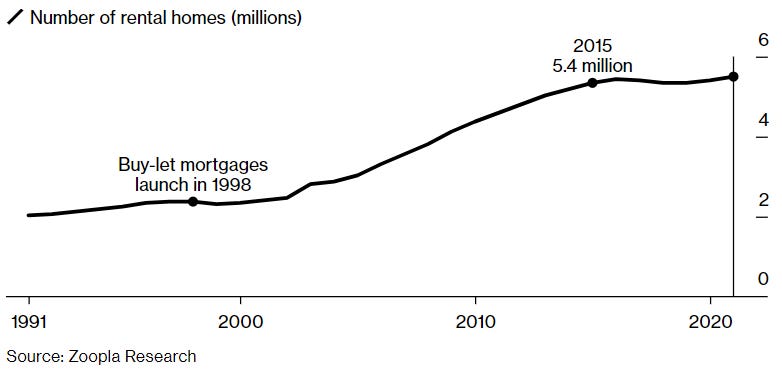

The continued rise in rental costs is believed to be largely driven by the lack of additional supply of rental homes in the country:

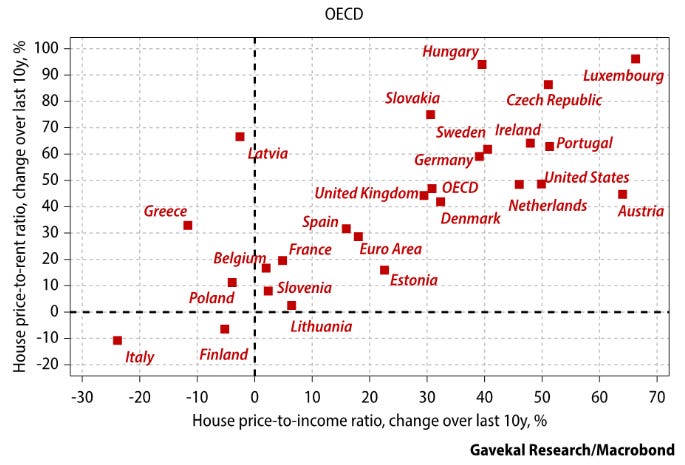

Unsurprisingly, the U.K. is not alone. Many developed countries have seen house price-to-rent ratios and house price-to-income ratios jump significantly over the last 10 years, as illustrated by the following chart:

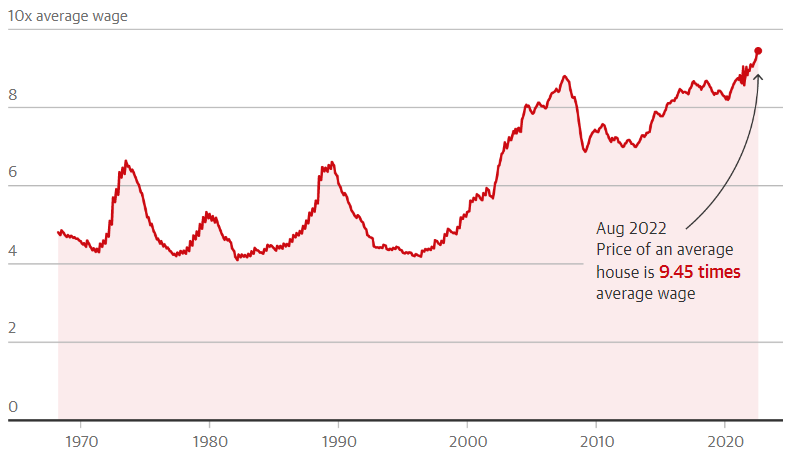

In the U.K. for example, as of August 2022, the price of an average house is over 9 times average wages, up from around 7 times 10 years ago and around 4 times in the early 1980s.

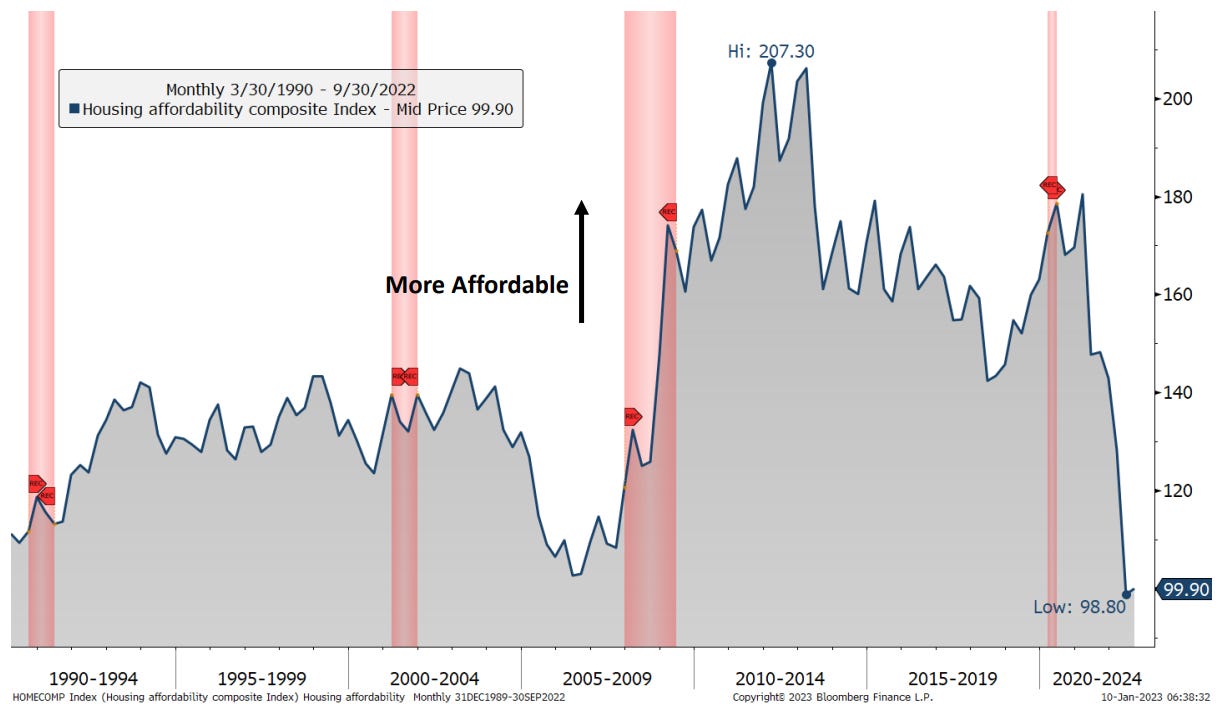

In the U.S. the housing picture is not much brighter, with affordability levels lower than during the housing bubble that preceded the global financial crisis back in 2007/08.

It will be fascinating to see how higher interest rates and inflationary pressures impact these ratios going forward, given their implications for mortgage costs and house prices.

Earnings commentary insights

BlackRock highlights the attractive yields available to investors today

CEO: “For the first time in years, investors can actually earn very attractive yields without taking much duration or credit risk. Just a year ago, the U.S. 2-year treasury note was yielding approximately 90 basis points [0.9%], and today, they’re earning over 4% with corporate bonds earning over 5 and high-yield earning 8[%].”

Wells Fargo starting to see some impact of higher rates on consumer spending

CEO: "We are starting to see the impact on consumer spend, credit, housing, and demands for goods and services, but at this point, the impact of consumers and businesses has been manageable…. the rate of impact we see in our customer base is not materially accelerating…. Our customers have remained resilient with deposit balances, consumer spending and credit quality still stronger than pre-pandemic levels."

J.P. Morgan sees consumer strength continuing with balance sheets in good shape

CEO: “The consumer is still strong. Their balance sheets are in good shape. They’re spending 10% more than pre-covid. They have more in their checking accounts. Companies are in good shape, and that’s driving a strong economy.”

Pioneer Natural Resources emphasises that the rapid growth of shale is over

CEO: “The aggressive growth era of US shale is over. The shale model definitely is no longer a swing producer.”

Articles

Saudi Arabia says it is open to settling oil trade in other currencies

The country’s finance minster, Mohammed Al-Jadaan, said “There are no issues with discussing how we settle our trade arrangements, whether it is in the US dollar, whether it is the euro, whether it is the Saudi riyal”. This comes a month after China and Saudi Arabia upgraded their relations to a strategic partnership during Chinese President Xi Jinping’s visit to Riyadh.

China’s population shrank for the first time in 60 years

Official results highlight how China’s demographic challenges continue to deepen. Women had 9.56 million babies last year, a 10% drop from 10.62 million in 2021, according to the National Bureau of Statistics. The national birth rate fell to a record low of 6.77 births for every 1,000 people in 2022, down from 7.52 in 2021, marking the lowest rate since records began in 1949.

BlackRock halts withdrawals from £3.5 billion UK property fund

The company has suspended withdrawal requests from investors in the fund. Investors in the fund include pension funds and other institutional investors.

Until next time...

Thank you for reading this week’s issue.

Do you have any questions or thoughts? Please feel free to reach out.

Have a wonderful week.

Why ‘Buy the Umbrella’?

Individuals, many of whom also run businesses and governments, tend to not think of the downside when the present is stable, and the future is looking positive (usually when we feel most in control).

Just because it is currently sunny, does not mean it will never rain. If we are not prepared, once it does begin to rain, we will end up running around looking for an umbrella in the middle of a storm when they are typically in short supply. We therefore need to ‘buy the umbrella’ before it rains.

Simultaneously, we cannot allow our awareness of risk to make us fearful, pessimistic, or paranoid, as this too works against us over the long-term.

Having the right mindset in advance is critical. The challenge is getting the right balance between being optimistic about the future and being able to not only withstand future crises, but in fact grow stronger due to the opportunities they tend to present.

It is not enough just to be conservative. One needs to be willing to put cash to work when others feel least comfortable doing it. To do that with confidence, we need to have a foundational understanding of history, business, markets and human psychology.

Our mission at BTU is to learn as much about the world as possible, and in doing so, to try to find investment opportunities with favourable risk/reward characteristics. These should, over the long term, help build sustainable wealth.