'Buy the Umbrella' - Issue #45

Hi there!

Here is your latest dose of ‘Buy the Umbrella’, a short list of interesting things we’ve been reading and thinking about during the week.

Twitter, which ran our prior newsletter platform, has decided to shut it down. It turns out that the half of their workforce that they laid off did do some work after all. Joking aside, we have had to migrate to a new platform as a result, which you will probably have noticed by now.

If you missed our prior issue, you can find it here.

Quotes

“Humans have a strong desire to be part of a group. That desire makes us susceptible to fads, fashions and idea contagions.”

— Michael Mauboussin (Head of Consilient Research at Morgan Stanley)

“The trees that are slow to grow bear the best fruit.”

— Molière (French playwright / actor)

Charts

Decline in U.S. government 30-year bonds

This fascinating chart, put together by Bank of America, illustrates drawdowns since 1987 for the 30-year U.S. treasury. As is evident, the 40%+ decline in 2022 has been particularly painful for long-duration bond investors.

This raises interesting questions such as: if interest rates are unlikely to go back to zero any time soon and investors’ bond portfolios have taken a double digit hit this year, will they choose (or perhaps be forced) to sell other assets to rebalance their portfolios? If so, what will they sell?

Financial market liquidity

Since the global financial crisis, the mantra “don’t fight the fed” had been regularly repeated. It referred to the notion that you did not want to bet against the major central banks, which from 2009-2021 kept interest rates low and were pumping liquidity into global markets, therefore supportive of higher asset prices.

Since March 2022 however, central bankers have reversed course, raising rates and begun to drain liquidity to fight inflation and slow an overheated economy (known as “tightening” monetary policy).

Now it seems, some investors have decided to ignore the relevance of the aforementioned mantra. These investors are hoping for a quick “fed pivot” or in other words, seeing the fed and other central bankers returning to their previous stimulative policies.

“I got everybody tightening and telling me they’re going to tighten more, and I got markets that just don’t believe it. We don’t have coordinated tightening around the whole world with everybody tightening at the same time too often.” — David Tepper (Founder and President of Appaloosa Management)

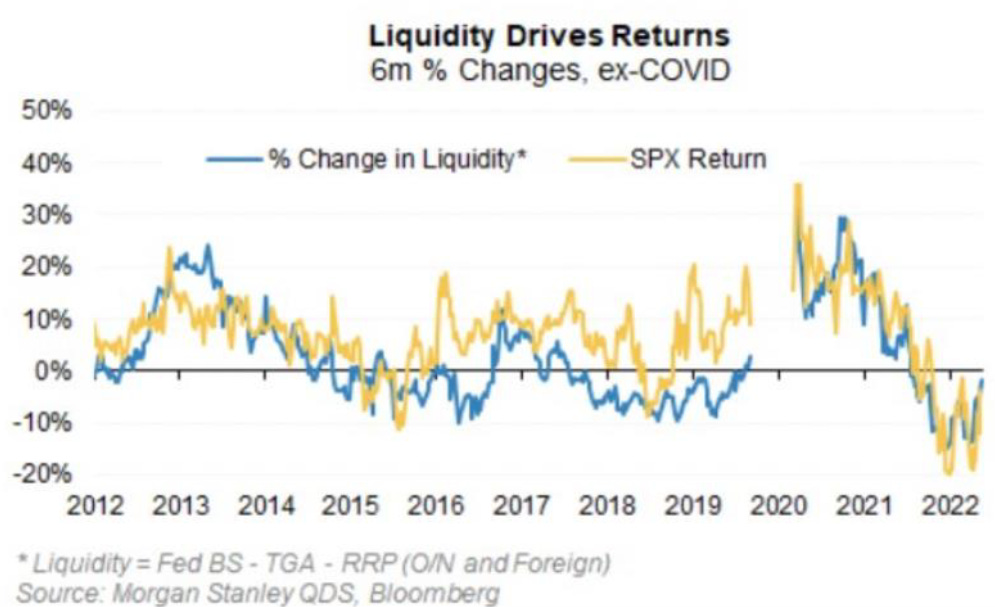

To illustrate the importance of liquidity to asset prices, Morgan Stanley put together this great chart which shows that when liquidity is rising (defined as growth in the federal reserve’s balance sheet, reduction in the treasury general account and reduction in the reverse repurchase facilities), S&P500 returns tended to be positive, with the opposite true when liquidity is shrinking. Simply: liquidity drives returns.

“The major thing we look at is liquidity.” — Stanley Druckenmiller (Chairman and President of Duquesne Capital)

It’s worth briefly looking at each of these individual components which define liquidity in the chart above.

Federal reserve balance sheet

Since late-2008, the federal reserve has kept interest rates low and embarked on several ‘quantitative easing’ rounds, essentially a form of money printing.

During the onset of the covid-19 pandemic, it aggressively expanded its balance sheet, buying treasuries and mortgage-backed securities (MBS), resulting in its total assets growing from around $4 trillion in March 2020 to $9 trillion at its peak in April 2022. By acquiring these assets from investors, the central bank added significant liquidity to the financial system.

The Fed began to raise rates in March 2022 and in June it stopped replacing some of the bonds it owned that matured, a process referred to as ‘quantitative tightening’, which reduces market liquidity. In September, this process swung into full gear with the Fed permitting up to $60 billion a month in Treasury debt and $35 billion per month in MBS to mature and therefore reducing the size of its balance sheet.

Since its peak in 2022, this has declined by around $0.5 trillion, withdrawing market liquidity.

Treasury general account

The second variable in the Morgan Stanley chart is the ‘treasury general account’ (TGA). This is basically the U.S. government’s current account. All disbursements are made from this account, while tax receipts and sales of treasury debt are paid into it.

From a liquidity stand point, when the balance in this account declines, as has been the case since its peak back in May this year, liquidity is injected into the financial system. Interestingly, we are fast approaching the 2010-2022 average balance (the red line), suggesting this mechanism will soon turn neutral or potentially even start to pull liquidity out of the system, especially if the Treasury decides to replenish the account with new debt issuance (which takes cash out of investors’ hands).

Note: The U.S. Congress passed a $1.7 trillion spending bill on December 23rd that will need to be financed.

Since the start of 2022, the TGA has increased by $0.2 trillion, withdrawing market liquidity.

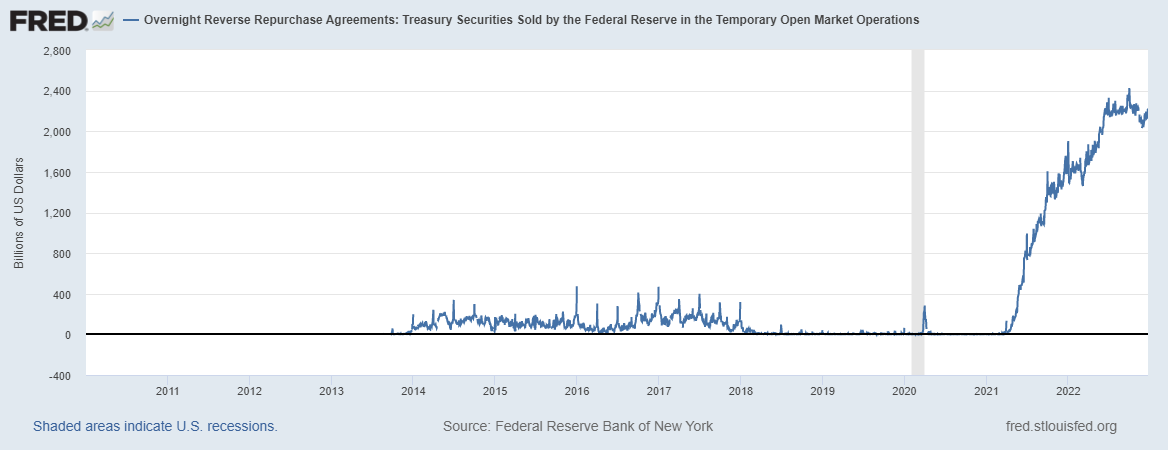

Overnight reverse repurchase agreements

The final element is the overnight reverse repurchase “repo” agreements. This account tracks temporary open market operations that are designed to temporarily add or drain reserves in the banking system, and therefore add or subtract liquidity. Simply, when this account’s balance rises, it indicates liquidity is being removed from the financial system.

The chart illustrates the rapid rise in excess banking reserves (over $2.2 trillion) that the fed has had to drain since 2021. While this has recently declined somewhat, it hardly suggests a shortage in banking reserves.

On November 30th, Federal Reserve chairman Jerome Powell said "it's really a public benefit to have plenty of reserves, plenty of liquidity in the markets and in the banking system, in the financial system generally." Given its importance, we should probably keep at least one eye on it, especially in moments like today where the fed is looking to slow the economy and maintain (or perhaps regain) credibility with regards to its 2% inflation target.

Since the start of 2022, reverse repos have increased by $0.6 trillion, withdrawing market liquidity.

In summary, when combining these three elements, the federal reserve has effectively tightened monetary policy by draining around $1.3 trillion out of markets since the start of 2022 (so far).

Earnings commentary insights

Micron Technology: On “solid footing” to navigate the near-term environment

CEO: “In the last several months, we have seen a dramatic drop in demand. Micron has responded quickly to reduce our CapEx and supply output, and we are taking strong enterprise-wide actions to control our expenses… we currently expect second half fiscal 2023 revenue to improve from the first half.”

FedEx: Industrial economy is slowing around the world with Europe being the hardest hit

CEO: At the same time, “there is an e-commerce reset", therefore the company will accelerate progress on “cost actions, helping to offset continued global volume softness.” Regarding China, “we haven’t seen any fundamental change in volume profile one way or the other in the last few weeks.”

Nike: Consumer demand for its portfolio of brands continues to drive strong business momentum

CEO: “Our growth was broad-based and was driven by our expanding digital leadership and brand strength”.

Reflection of the month

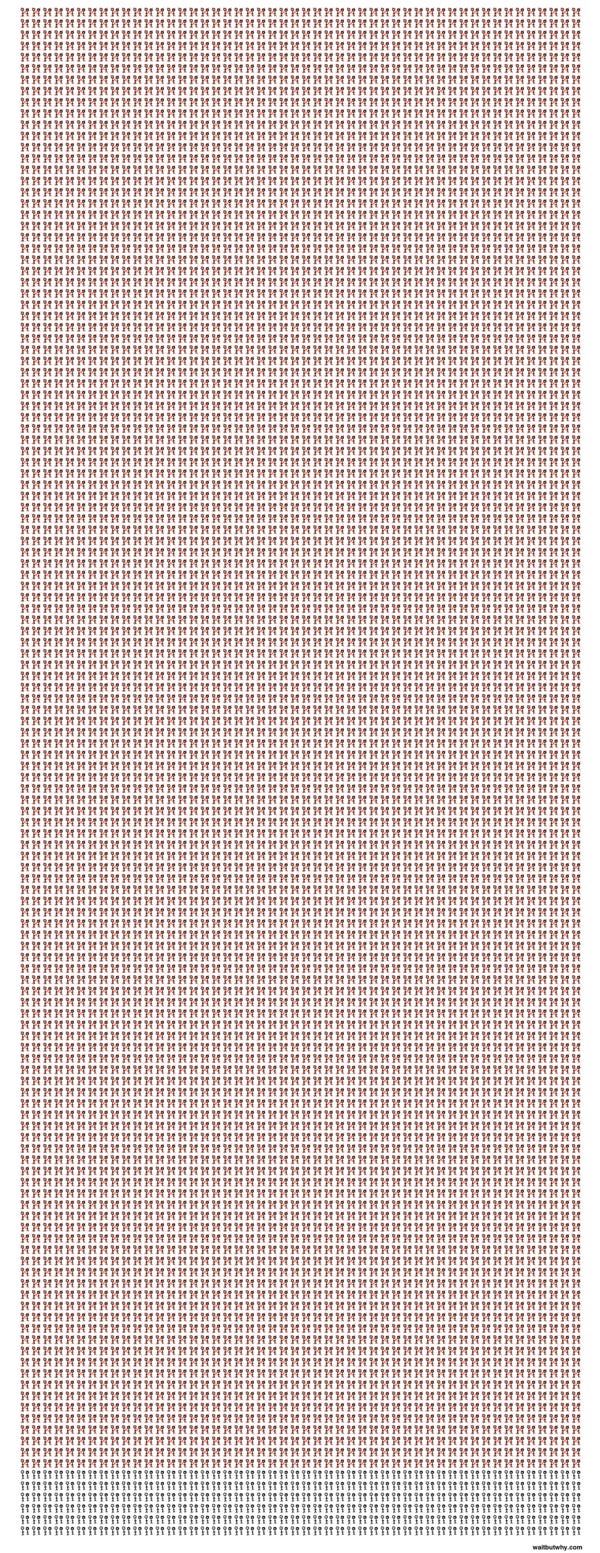

The ‘The Tail End’ by Tim Urban is worth reading at least once every few years. It’s a short, creative and fitting read as we catch-up with family/friends and reflect during the holiday season, reminding us about our short time on this planet.

Urban’s piece encourages us to reflect and be more thoughtful about how we spend our time. Below is an excerpt and graphic which will hopefully encourage you to read the whole piece:

I’ve been thinking about my parents, who are in their mid-60s. During my first 18 years, I spent some time with my parents during at least 90% of my days. But since heading off to college and then later moving out of Boston, I’ve probably seen them an average of only five times a year each, for an average of maybe two days each time. 10 days a year. About 3% of the days I spent with them each year of my childhood.

Being in their mid-60s, let’s continue to be super optimistic and say I’m one of the incredibly lucky people to have both parents alive into my 60s. That would give us about 30 more years of coexistence. If the ten days a year thing holds, that’s 300 days left to hang with mom and dad. Less time than I spent with them in any one of my 18 childhood years.

When you look at that reality, you realize that despite not being at the end of your life, you may very well be nearing the end of your time with some of the most important people in your life. If I lay out the total days I’ll ever spend with each of my parents—assuming I’m as lucky as can be—this becomes starkly clear:

You can read Tim Urban’s full article by clicking here.

Until next time...

Thank you for reading this week’s issue.

Do you have any questions or thoughts? Please feel free to reach out.

We wish you and your loved ones a merry Christmas and a happy new year!

Have a wonderful week.

Why ‘Buy the Umbrella’?

Individuals, many of whom also run businesses and governments, tend to not think of the downside when the present is stable, and the future is looking positive (usually when we feel most in control).

Just because it is currently sunny, does not mean it will never rain. If we are not prepared, once it does begin to rain, we will end up running around looking for an umbrella in the middle of a storm when they are typically in short supply. We therefore need to ‘buy the umbrella’ before it rains.

Simultaneously, we cannot allow our awareness of risk to make us fearful, pessimistic, or paranoid, as this too works against us over the long-term.

Having the right mindset in advance is critical. The challenge is getting the right balance between being optimistic about the future and being able to not only withstand future crises, but in fact grow stronger due to the opportunities they tend to present.

It is not enough just to be conservative. One needs to be willing to put cash to work when others feel least comfortable doing it. To do that with confidence, we need to have a foundational understanding of history, business, markets and human psychology.

Our mission at BTU is to learn as much about the world as possible, and in doing so, to try to find investment opportunities with favourable risk/reward characteristics. These should, over the long term, help build sustainable wealth.